During the COVID lockdown, I wondered if things would ever go back to the way they were. It was a time of much uncertainty. Would I ever travel again? Watch a concert? Eat in a restaurant? This was the time I had to sit down and pay attention to the digital advances around me. Prior to the lockdown, I pretty much ignored e-wallets and banking apps. When physical transactions were limited, I had to familiarize myself with everything. The fact that I could do so much on the BPI app reaffirmed that moving my personal funds to BPI was the right move.

After the lockdowns and quarantines, I think most of us emerged as different people. I for one had lost all interest in buying designer bags and other luxury items. Lockdown made me realize that experiences are the more priceless investments. I used to be unwilling to spend money if I would have nothing to show for it in the end. These days, I prefer to indulge more in food, travel, and experiences like concerts and performances. I enjoy the simple things more, like walking outside when the weather is cool.

There was a lot of bayanihan going on that time. Our own neighborhood formed a pasabuy group where we would help each other source food and essentials since going out was not so easy. I also gained a new appreciation for enterprises that did business while helping out communities. It was then that I first heard of Rural Rising Philippines, a social enterprise that would “rescue” farmers’ surplus harvest and help sell them to people in cities who need them. I myself had tried buying a batch of produce from such rescue efforts and it was very much worth it. Rural Rising started out as a small operation and has since evolved into a more organized social enterprise with a full e-commerce venture complete with an ordering and tracking system.

Another such enterprise I admire is Rags2Riches (R2R). R2R creates eco-ethical fashion and home accessories by partnering with community artisans. They upcycle fabric waste and use local materials to produce an array of quality handcrafted goods. Aside from providing a sustainable livelihood for artisans, fabric waste is put to good use. R2R also started small in Payatas. I remember coming across woven purses and wallets from them. By now they too have a full e-commerce operation that rivals even imported brands.

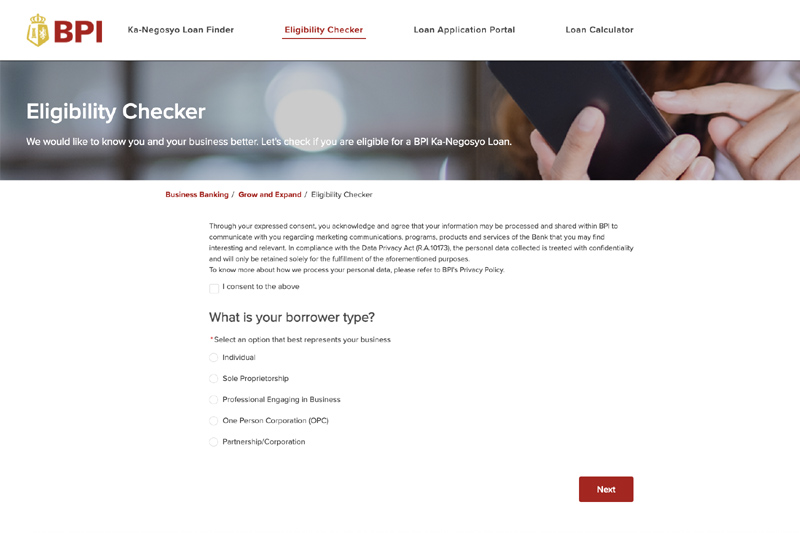

It’s all very inspiring and it just goes to show that it’s okay to start small and grow from there. I consider myself a tech savvy person so if I were to start a business or social enterprise, I see it going towards the e-commerce route as well. For a potential endeavor such as this, I was happy to find out that there are financial options I can avail of to help kickstart any ideas I might have. For example, I tried BPI’s eligibility checker to see which loans were best for me. I was surprised to see that availing of a small business loan is not as inaccessible as I thought it was. Even applying is easy and hassle-free through the Ka-Negosyo On The Go online loan application. These are also Ka-Negosyo Loans for SMEs who want to grow or take their business further and do even more good. 🙂

It’s all very inspiring and it just goes to show that it’s okay to start small and grow from there. I consider myself a tech savvy person so if I were to start a business or social enterprise, I see it going towards the e-commerce route as well. For a potential endeavor such as this, I was happy to find out that there are financial options I can avail of to help kickstart any ideas I might have. For example, I tried BPI’s eligibility checker to see which loans were best for me. I was surprised to see that availing of a small business loan is not as inaccessible as I thought it was. Even applying is easy and hassle-free through the Ka-Negosyo On The Go online loan application. These are also Ka-Negosyo Loans for SMEs who want to grow or take their business further and do even more good. 🙂

I don’t have any experience loaning for business but I’ve had a very positive banking experience with BPI, so they are top of mind when it comes to my financial needs. I used to think that business loans are huge amounts that are not really accessible to ordinary folk but the recommendations given online have all been very realistic.

As for me, I’ve been going around a lot during my travels in search of inspiration. What do other countries have that we don’t? What need can we address while helping the community and earning at the same time? The idea is there — and now I feel more confident in pushing through knowing that I have access to solid financial support from my bank. This, I believe, is how I can do well while doing good.

Like this post? Subscribe to this blog by clicking HERE.

Let’s stay connected: